by Steve Cortes

The current confluence of economic conundrums elevates risks massively for the prosperity of Americans, especially those of modest means. These unprecedented, concurring economic contradictions flow directly from the dire mistakes of the 2020 virus panic.

The seismic policy errors of the lockdown era have since been exacerbated by Joe Biden and aligned collaborationist Republicans, to create an economic cauldron into the end of 2023.

What are these conundrums?

1. Interest Rates surging into a slowing economy.

2. Energy prices soaring despite China and other Emerging Markets decelerating.

3. U.S. Housing prices rising in the face of plunging Mortgage demand.

Conundrum #1: Rate Rise as Economy Slows

On that first point, just last week, the Federal Reserve roiled capital markets by warning about the need to keep interest rates higher for longer to fight persistent inflation. But soon, even that volatility will likely seem tame by comparison.

In normal economic cycles, interest rates rise anticipating that fast economic growth triggers a shortage of capital and/or high demand for loans. But in this present quagmire, none of those typical dynamics exist.

Since the lockdowns, the “15 days to slow the spread” announcement from the White House and Fauci in March of 2020, benchmark 10 Year Treasury yields have screamed higher, from 0.80% then to 4.50% last week, the highest level since 2007.

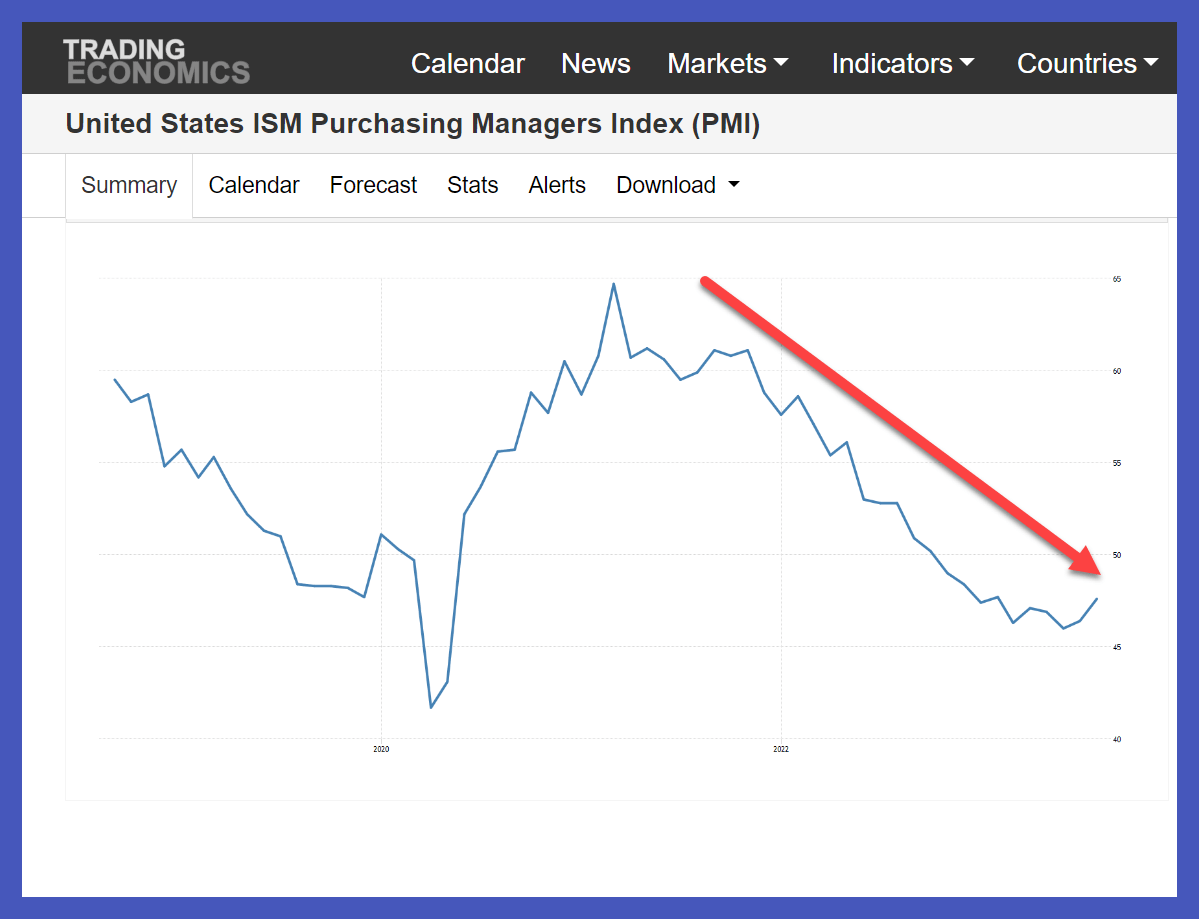

But simultaneously, signs of economic slowdown proliferate. For example, the best gauge for production, the ISM Manufacturing PMI, has now registered 10 straight months in contraction, recessionary mode, which is below 50 on that index. See this 5-year chart:

Consumers reflect that factory weakness, too. Though consumer confidence has bounced a bit in recent weeks, it still sits below the worst levels of the lockdown depths of the spring of 2020. In fact, the gold-standard consumer confidence survey from the University of Michigan recently hit the lowest levels of all-time, in an index that goes back to the 1970s. Similarly, credit card losses just hit the worst levels since the Great Financial Crisis of 2008, as stressed borrowers cannot make even minimum payments, per a Goldman Sachs report.

Yet, interest rates charge higher anyway. Why?

The answers all flow from the policy disasters that began with the virus panic. The unscientific and largely illegal lockdowns were temporarily “financed” by taking the U.S. to unprecedented post-WWII levels of spending and borrowing. Throwing money at people to stay home and businesses that were forced to shutter resulted in runaway debt, rocket-ship inflation, plus a systemic level of fraud thrown in, to boot.

Those giant mistakes were only amplified once Biden took office. Rather than taming this insane fiscal profligacy, Biden and his willing GOP allies on the Hill, like Mitch McConnell, simply pretend that the crisis-level binge can continue, and even accelerate.

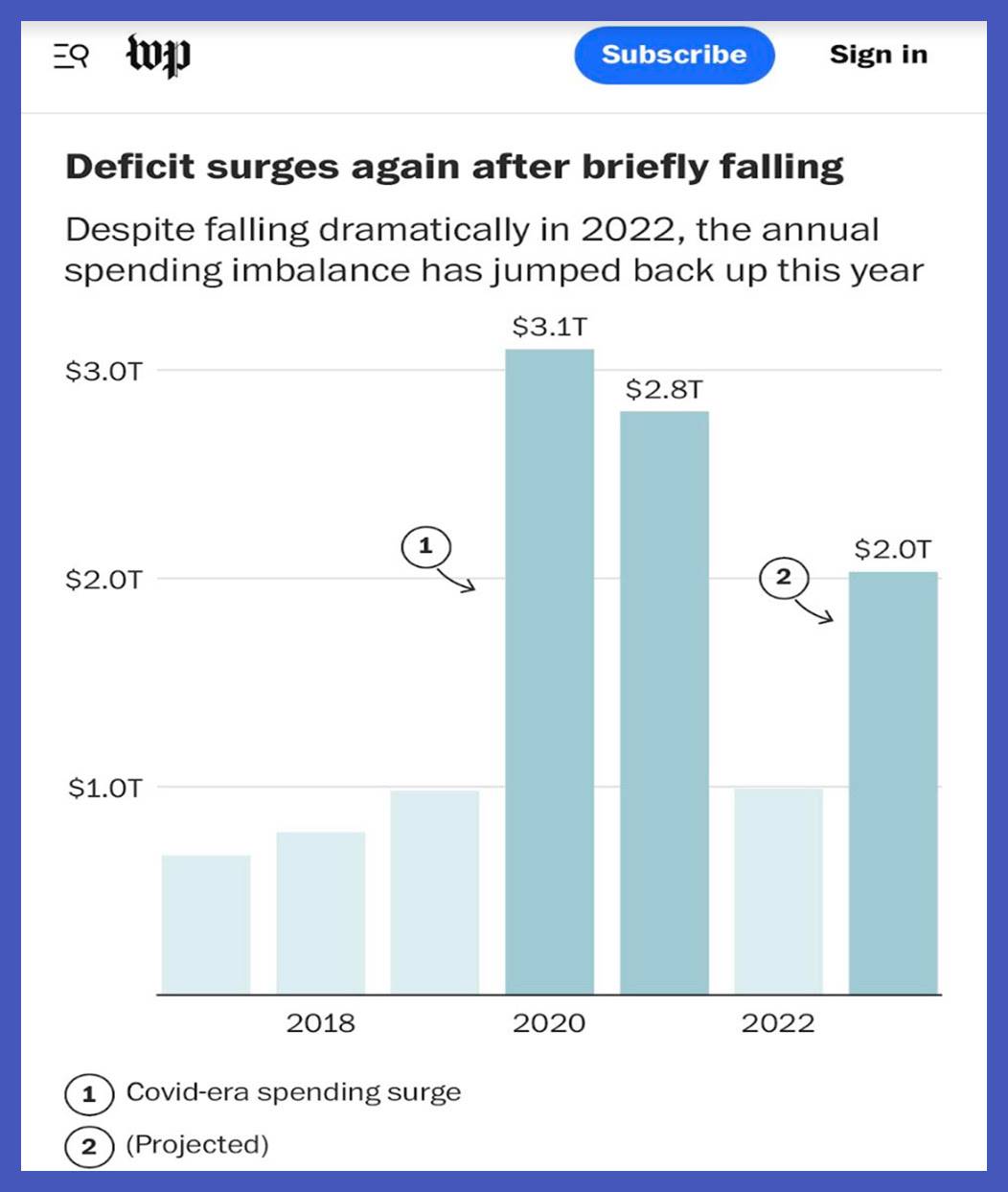

So, instead of policy and inflation normalizing, the deficit doubled this year vs. last year. Even the biased Washington Post took note, with an alarming article and this graphic:

This path is totally unsustainable. In the prior era of low rates and monetary repression from the Fed, large deficits seemed manageable. No longer. The costs now of financing this ballooning debt will quite literally impoverish our children.

Conundrum #2: Oil Soars While China Slides

For years now, China has been the foremost driver of global oil prices. Its smokestack economy is far more petroleum-centered than America’s. In addition, unlike the U.S., China lacks the kind of vast natural energy resources to meet industrial demand from domestic drilling.

But in recent quarters, a notable and new disconnect emerges – Crude Oil explodes higher even as China tanks.

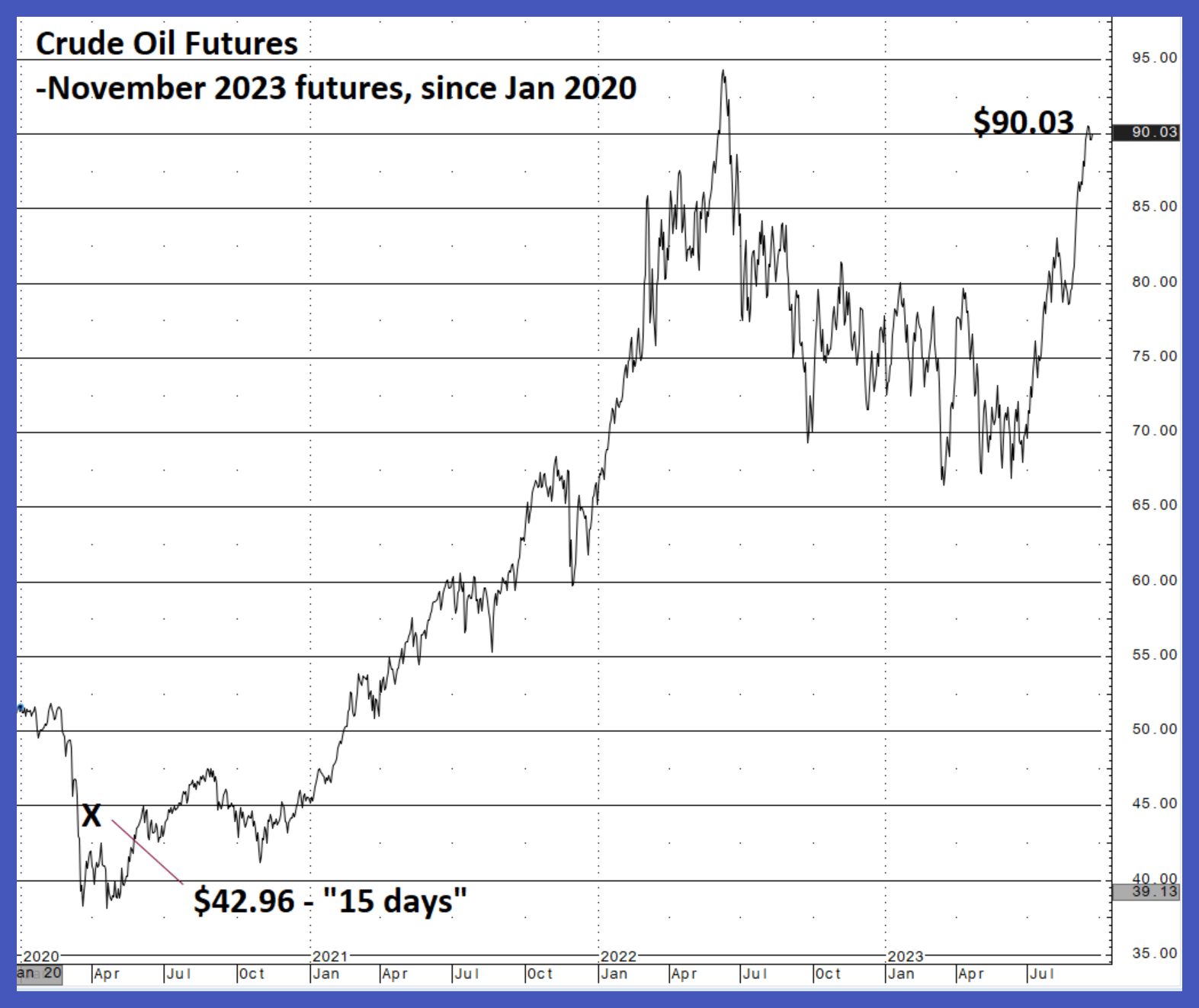

Look at the price trajectory of Crude since the March 2020 “15 days” propaganda. Black Gold more than doubled and now sits just above $90, threatening last year’s painful highs:

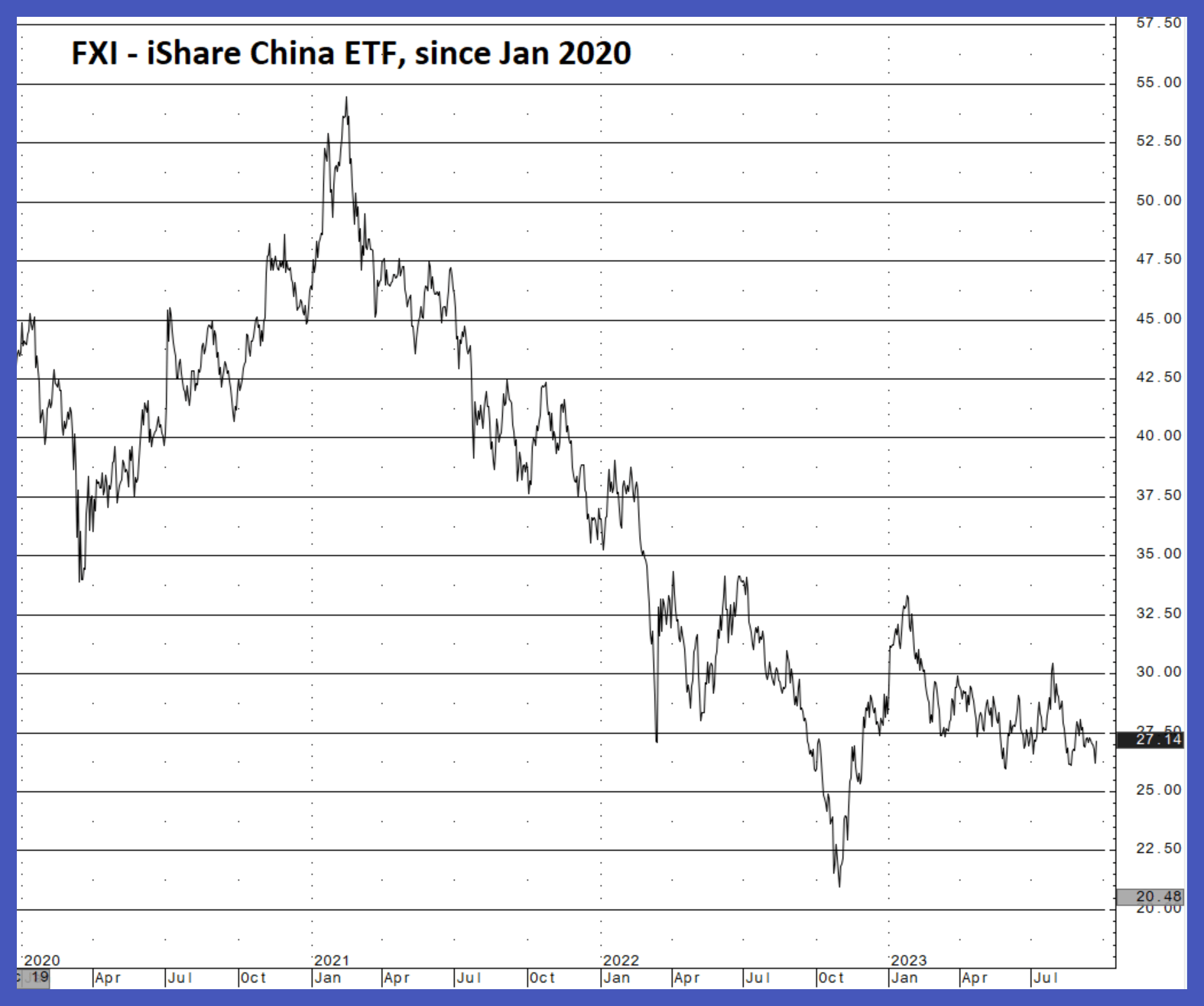

But, conversely, the capital markets outlook for China falls apart, as evidenced by FXI, the primary vehicle for U.S. investors to trade Chinese shares. It is an ETF (exchange traded fund) basket of Chinese stocks:

So, what gives? Well, the inflation that was sparked by the 2020 fiscal orgy sent Oil and all commodities to the moon, as inflation protection assets. Then, adding to that crisis, Biden’s war on American energy made production here in “Saudi America” more difficult. Simultaneously, rising rates in the U.S. create a massive headache for Chinese government-run industries, which are heavily indebted in U.S. Dollars. Hence…another conundrum.

Conundrum #3: Housing Prices High Even as Mortgage Demand Tanks

Given sky-high interest rates and an embattled consumer, naturally mortgage demand falls off a cliff. In fact, mortgage applications have now plunged at the worst clip in almost 30 years.

Here is Joel Kan, chief economist from the Mortgage Bankers Association assessing the present desert of demand: “Mortgage applications decreased for the seventh time in eight weeks, reaching the lowest level since 1996.” He further predicted: “Given how high rates are right now, there continues to be minimal refinance activity and a reduced incentive for homeowners to sell and buy a new home at a higher rate.”

But…despite this collapse in mortgage applications and approvals, home prices remain very elevated. In fact, comparing present prices to levels before the virus panic, St. Louis Fed numbers show a median priced U.S. home rose from $313,000 in the beginning of 2019 to $416,000 today. One would suspect that trouble for potential buyers would compel lower home prices, but no such luck for would-be homeowners.

As a result, housing affordability melts down to the worst levels ever, as I outlined in my previous article on this particular economic enigma.

Conundrum to Cauldron

Taken alone, any one of these three crises listed above can derail an economy.

All three put together, that confluence creates an economic cauldron.

Our country and our movement, therefore, need to get serious immediately about fiscal sanity. Deficits matter again, in spades. We also need to fully unleash American energy, eliminate hurdles to housing construction, and seal the border to raise the wages of American citizens. The economic clock is ticking…time for action.

– – –

Steve Cortes is a contributor to American Greatness.